Business appliance of AI is picking up steam. According to SAS, ⅔ of companies from different industries expect their activities will be shaped by AI within next 5 to 10 years. However, high enthusiasm is hampered by the lack of organizational readiness. Many hesitate whether it is worth starting now — often discouraged by the cultivated opinion that AI is only for big players. But is it really so? And how to use AI in small business? Let’s check it!

Well, just a few examples to start with. No, not from Google or Amazon.

A winemaker from Piedmont realizes that the quality of his wine (and the success of his business) depends on calculations no less than production efforts. So, he joins forces with the leading Italian-German AI software company Ors Group. The result of their three-year collaboration is Algo-Wine, a software which makes the exact predictions when it is best to harvest grapes. It brings the winemaker up to 30% of the annual benefit. Sounds alluring, doesn’t it?

A small online accounting business works hard to make managing and filing accounts easy and quick. It establishes an ongoing research project and introduces cloud-based AI software aimed at automating accounting tasks for their clients. In 2017 it wins the title of Practice Excellence Pioneer, the most prestigious award in the accounting industry. This very year it turns over £ 1 million. Not a bad result for the company with just 30 employees.

Learn more about how we developed an AI agent for a customs brokerage company in just one month, cutting document processing time by 67%.

A jewelry shop from Diamond District, struggling severe competition, finds rescue in introducing a virtual gemologist that uses AI to scour the global diamond marketplace. Just in seconds, it processes a million data points to help the customers make a perfect choice for the engagement ring. The clients are overjoyed: no more devastating search. The company owners are no less happy: about 2,000 competitors are left behind.

Well, maybe you don’t need to be persuaded anymore, but still, have a question about where to start from. Everybody talks about the importance of AI, but quite a few explain how to use AI in business development. Then, the first thing we need to figure out is what does AI mean in business.

What is AI in a Narrow and a Broad Sense

The term ‘artificial intelligence’ is used in different meanings now. In a narrow sense, AI only stands for the software that mimics the work of a human brain. In a broader sense, AI is used as an umbrella term for several different technologies which include:

- Machine learning. ML uses statistical techniques to improve computer system performance based on various data without or with minimal human intervention. Facebook’s facial recognition is a good illustration of how it works.

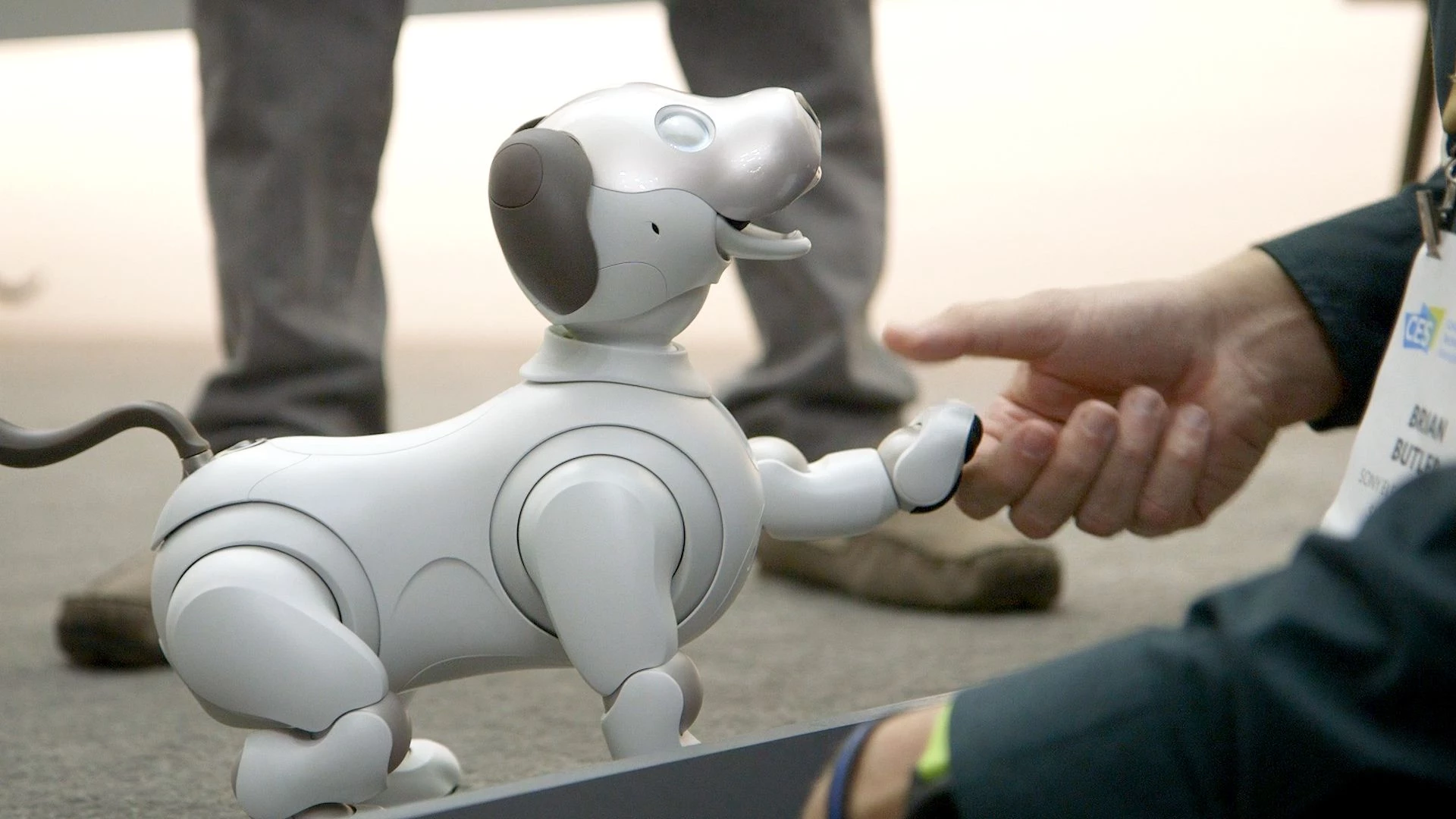

- Smart robotics. Today’s smart robots are AI systems that apply ML techniques to grasp information from the environment. They are already used in a number of industries and fulfill tasks from medical diagnostics to cooking pizzas.

- Virtual assistance. A virtual assistant is a software agent that uses cognitive computing to offer customers 24/7 help when using websites or searching for information. Maybe, you have already had a chance to get acquainted with such virtual assistants as Amy from X.ai and IBM’s Watson.

- Decision management. Automated decision support relies on the ability of rule-based systems to make decisions for repetitive management problems without human involvement. AI-based decision making is already used in transport management systems and online recruitment systems. One of the well-known leaders in this technology is Cypress Software Systems.

- Speech recognition. This is the ability of computer programs to listen to human speech and understand it. Amazon’s Alexa, Google’s Assistant, Microsoft’s Cortana and Apple’s Siri belong here.

- Natural language generation. This technology is aimed at analyzing data and transforming it into human-readable text. That’s what Forbes already uses to produce company earnings reports and Environment Canada applies for weather forecasts compilation.

These technologies are already applied in such a vast number of industries that they certainly deserve a special article — which we promise to provide. But whatever idea you decide to put into practice, you will begin with certain common steps of how to implement AI in business.

Want a web app that does more?

Let's build a solution that's smart, sleek, and powerful.

Alina

Client Manager

Implementing AI in Business: the First Steps

It’s impossible to introduce artificial intelligence in your company in a couple of days. Preliminary auditing and optimizing existing procedures and policies go a long way. You really need to start now if you don’t want to back off in some 5 or 7 years. Here is how to implement AI in small business.

Familiarize yourself with AI technologies. The first step if you don’t know how to apply AI in business is getting to know the tech. Learn what stands behind each of them and how they can be applied. You may find a lot of educational materials on Udemy, Coursera, and Udacity. NVIDIA has developed a comprehensive list of AI courses for various levels, starting from beginning to advanced — really handy. Try AI products yourselves to understand what you like and dislike about them. Brainstorm how your clients can use similar technologies while dealing with your products.

Rethink your business. Ask yourself where in your industry you can get a competitive advantage by applying AI. Or, by contrast, in what issues you lag behind. Think about how can AI be used in business to get up to speed. For example, if your trouble is finding leads, consider using machine learning for prospecting, advertising, and cold pitching. A smart chatbot may be useful if you need to improve an on-site engagement. Think about how you can add AI capabilities to already existing services. Some options of how to use AI in business intelligence are:

- improving your website,

- optimizing marketing campaigns,

- enhancing customer service,

- building social strategy.

Set measurable goals and address a technical expert for the advice.

Make preliminary estimations. Evaluate the costs of implementation. AI is different from traditional software in such terms that you can’t just set it and forget it. The process of machine learning needs to be monitored. Who are you going to entrust it? Are you going to reinforce your own staff with machine learning engineers or will you involve third-party professionals?

Get data-driven. To have where to learn from, AI needs a readily available dataset gathered in one place. So, to make a good base, start consolidating your data. It may include information from your CRM, ad campaigns, email lists, traffic analysis, social media responses, public information about your competitors etc.

Upgrade IT infrastructure. Examine whether your IT service needs a redesign in order to accommodate it to AI-driven solutions.

Choose one segment as a testing ground. Consider starting from one single segment of your business. Remember it is easier to fail with a «boil the ocean» project than with a smaller idea when it goes about artificial technology.

Benefits of Adopting AI in Business

Artificial intelligence may seem complex. Yet, it can actually make things simpler and better for companies. Here are some beneficial examples of why use AI in business.

Increased efficiency and productivity

One of the examples of how AI helps in business is boosting productivity. Artificial intelligence can automate repetitive, time-consuming tasks. This frees up your employees to focus on more complex, strategic work. For example, AI-powered chatbots can handle routine customer inquiries 24/7. It reduces the workload on your service agents. ML can also analyze vast data sets, uncovering patterns and insights humans might miss. This leads to smarter decision-making and streamlined processes.

Better data analysis and decision-making

In today's data-driven world, having the right information at your fingertips is crucial. Artificial intelligence can crunch those massive data sets in the blink of an eye. It identifies patterns and insights that would take a human team forever to uncover. It can analyze customer data to predict demand, find ideal locations for new facilities, optimize pricing strategies, and more. Artificial intelligence takes the guesswork out of major business decisions.

Improved customer experience

Another example of how can AI help in business is using chatbots and virtual assistants. They provide instant, accurate information to customers at any time of the day. These tools learn from each interaction to continually improve. AI can also personalize product recommendations, marketing messages, and service offerings to each customer based on their preferences and behaviors. In short, this technology allows you to better understand and cater to customer needs.

Cost savings and revenue growth

Artificial intelligence requires some upfront investment to implement. However, the long-term benefits include big cost savings. How is AI used in business today to reduce costs? This technology can automate tasks that humans used to do. This reduces workforce costs since you need fewer employees. The time and cost savings allow companies to invest more in growth, product development, and other revenue-generating areas.

This technology also helps businesses grow their revenue. It optimizes operations to be more efficient. It finds the best pricing models and marketing strategies. These optimizations lead to maximum profits and return on investment.

AI Applications Across Industries

Artificial intelligence is transforming businesses across different industries. It is driving efficiency, growth, and innovation. Let's explore some of the top ways of how to use AI in a business across various fields.

Marketing and Sales

Artificial intelligence is a huge asset for marketing and sales teams. It can analyze tons of data on customer behavior to provide insights into the best marketing strategies. AI-powered chatbots and virtual assistants can handle customer service inquiries in a personalized way. AI-powered tools can even create ads, emails, and social media content. Of course, all of them are tailored to specific audiences.

Finance and Accounting

Artificial intelligence excels at spotting patterns in large financial datasets. So, what can AI be used for in business in the financial industry? Banks use it to detect fraud, minimize risk, and suggest smart investments. Accounting firms use it to automate time-consuming tasks like data entry.

Intelligent systems can also automate bookkeeping tasks and provide financial forecasting. It can forecast everything from stock prices to currency exchange rates. AI-powered trading systems can make lightning-fast stock trading decisions too.

Human Resources

Hiring and retaining top talent is crucial. How is AI being used in business to help with HR management? It helps HR teams by scanning resumes and scheduling interviews. It can even ask preliminary interview questions, assess candidates for job fit, and identify hiring biases.

AI can track employee data to predict which individuals may soon leave. This allows companies to provide timely support and growth opportunities. Additionally, it can provide personalized learning recommendations.

Supply Chain and Logistics

Let’s see how to use AI in business selling goods. It makes the journey of products really smart. It plans the best routes for deliveries to take. Companies use AI to foresee product demand and optimize manufacturing, inventory, and shipping. Automated robots are taking over warehouse tasks like picking and packing orders.

Artificial intelligence also aids in automating warehouse operations through robotics and computer vision.

Healthcare

The healthcare industry is leveraging AI for diverse applications. Doctors use it to study medical images like X-rays and MRI scans. AI algorithms can detect diseases and conditions earlier. They analyze huge genomic datasets. This can lead to breakthroughs in personalized medicine.

AI also tests out new medical ideas by using computer simulations. No need for live experiments at first! Some programs give people medical advice too. You can get answers to questions about symptoms or medications. Artificial technology is making healthcare smarter and more available to everyone.

The future of artificial intelligence across all sectors looks remarkably promising. As technology continues to advance rapidly, we'll see even more amazing real-world applications emerge.

The Future of AI in Business

As AI-powered tools become more advanced and accessible, companies of all sizes are exploring ways to leverage this powerful technology. Many people are wondering how will AI affect business in the future. Well, this future is full of exciting possibilities and potential competitive advantages. Here are some key trends shaping the future of business.

Emerging AI trends and technologies

If you want to know how to start a business in AI, you need to keep up with the trends. One of the hottest AI trends is natural language processing. NLP allows computers to understand, interpret and generate human language. Many companies use NLP for customer service chatbots, voice assistants, automated writing, and translation.

Another big field is computer vision. It lets computers identify and understand images and videos the way human eyes do. It can be used for security cameras, checking products for defects, facial recognition to unlock your phone, and self-driving cars.

One big trend is large language models like ChatGPT. These are trained on huge amounts of digital data to understand and communicate in natural language. They can answer questions, write essays, code programs, and more. Capabilities keep expanding rapidly.

Artificial intelligence is transforming robotics in a big way. With AI controlling their movements, vision, and decision-making abilities, robots are becoming much smarter and more capable. Below, see how is AI used in businesses utilizing robots:

- Manufacturing. Robots can assemble products with high precision and efficiency.

- Healthcare. Surgical robots can assist doctors in performing complex operations.

- Logistics. Robots can sort, package, and transport goods quickly and accurately.

- Space Exploration. Robots can explore and work in harsh environments that are too dangerous for humans.

The combination of AI systems and robotic hardware enables these machines to take on tasks that were too difficult before. This revolution is making robots useful across many industries.

The role of AI in creating competitive advantages

A great example of how is AI used in business to make it more efficient is automating tasks. These tasks are usually repetitive, time-consuming, or too complex for humans. AI can work 24/7 without getting tired or making mistakes. This leads to more productivity, lower costs, and higher quality.

AI can also find powerful insights hidden in data. ML algorithms can analyze huge amounts of data. They uncover patterns that would be impossible for people to detect. Companies can use these AI-driven insights to make better decisions, predict future trends, improve processes, and personalize products and services.

With AI handling routine work and analysis, human employees can focus more on creative, strategic, and customer-focused work. Companies that integrate AI first could get a big competitive advantage over others in their industry.

Preparing for an AI-driven workforce

AI cannot fully replace human ingenuity, emotional intelligence, and ability to think abstractly. It works best with human oversight. While AI will automate some jobs, it will also create brand new types of roles that don't exist today. Companies will need people with skills to develop, use, and maintain AI systems. Businesses might educate their workers on how AI can be used in business yo achieve its goals.

Businesses need to train current employees in artificial intelligence. Business leaders must also think carefully about ethics with AI. They need to develop guidelines to use it responsibly without bias, privacy issues, or other harm. Building trust in AI will be crucial for its successful adoption.

The future of business lies in human-AI partnerships. Companies adapting to this emerging reality can unlock AI's full transformative potential.

Now, you know how can you use AI in business. This FAQ aims to address common questions and concerns about integrating AI technology into your operations.

FAQ

How can small businesses benefit from AI technology?

AI can help small businesses work smarter, be more efficient, and provide better customer experiences. Here is what is AI used for in business to make it more successful. AI can help small businesses work smarter, be more efficient, and provide better customer experiences. Here is what is AI used for in business to make it more successful. AI can help automate repetitive tasks like data entry, scheduling, and customer service chatbots. Chatbots and virtual assistants can provide quick and efficient customer support. This saves time and money. AI can analyze customer data to provide personalized marketing messages and product recommendations. AI can help optimize things like inventory management, supply chain, and resource allocation to make better business decisions. It can analyze data to predict future trends, sales patterns, and customer behavior. By automating tasks and optimizing operations, AI can help small businesses reduce costs.

What skills do employees need to work effectively with AI systems?

To work effectively with AI systems, employees need to have certain important skills. They should understand how to work with data, collect, analyze, and interpret it. Employees should be able to identify problems that AI can help solve and translate them into tasks that AI systems can perform. At the same time, they need to think critically about the outputs and recommendations provided by these systems. They should question the results and not blindly accept them. What’s more, employees should understand the potential for bias and ethical concerns in AI systems to timely mitigate these issues. Adaptability and basic coding/technical skills will be of use to understand how AI used in business can be more effective and what new skills and techniques are needed for using these systems.

How much investment is typically required to adopt AI in a business?

The investment required to adopt AI in a business can vary significantly. It depends on how AI is used in business, and the size and complexity of the organization. The level of customization required is also a factor. Small businesses may need to invest between $10,000 and $100,000 for basic AI implementations. Larger enterprises could spend millions on advanced solutions. Yet, the potential ROI from increased efficiency and productivity can often justify the upfront costs.

Conclusions

Just like the Internet changed all our way of life in the last two decades, similarly, AI is going to become an unrivaled force of transformation in the nearest future. And the sooner you start to analyze the areas where AI can enhance your business, the better positioned you will be in the market competition.

Adoption of AI relies on practical readiness. This means having the tools and skilled staff in place to be able to exploit the technology effectively. The initial steps on introduction AI into your company’s workflow include:

- familiarizing with AI technologies;

- deep analysis of your business with a view to introducing AI-driven solutions;

- preliminary cost and personnel estimation;

- data consolidation;

- adjustment of company IT infrastructure;

- allocating an experimental segment for the soft launch.

It all may seem too complicated at first sight. But don’t get too concerned and trapped by fear. In fact, it is much more likely to fail with traditional software application than with AI.

And which stage are you at? Let’s walk this path together! Contact us at info@stfalcon.com.