The robots are coming! Rather than fearing a robot apocalypse, the financial services industry is embracing automation. Robotic Process Automation (RPA) is transforming how banks, insurance companies, and other financial institutions operate by streamlining repetitive, rules-based tasks. RPA bots can work around the clock without ever getting tired.

The benefits of RPA in finance operations are too substantial to ignore. This technology is fast becoming a competitive necessity. Firms that fail to adopt automation software risk falling behind rivals in automating processes cost-effectively. The RPA in finance case study showed a 75% reduction in costs after the implementation of automation bots.

Read on to learn how Robotic Process Automation is revolutionizing financial services. We will look at real-world use cases, benefits, and challenges for robotic process automation in finance.

Stfalcon can help you leverage Robotic Process Automation (RPA) for financial services by automating repetitive, rules-based tasks for greater efficiency. Contact us, and we will implement your idea into reality

What Does RPA Stand For? What is the reason behind banks' investments in RPA tools?

RPA stands for Robotic Process Automation. It refers to software tools that automate repetitive, rules-based processes usually performed by human workers. These digital colleagues are capable of executing a plethora of functions. They process invoices, reconcile accounts, and generate reports, all without a coffee break.

Banks and other financial and accounting services institutions are investing in RPA. There are several reasons for this.

- Improve efficiency. Bot technology automates manual processes efficiently. It reduces processing times and allows workers to focus on higher-value tasks. This boosts productivity.

- Reduce costs. By automating manual tasks, RPA reduces the need for staffing for certain processes. This cuts labor costs.

- Enhance compliance. Bots are programmed to follow strict operational parameters. This ensures consistency and accuracy and improves compliance. This robotic adherence to rules simplifies audit processes. It also reduces the risk of fines resulting from non-compliance.

- Improve customer experience. Customers expect quick and efficient service. RPA accelerates service delivery. This is particularly evident in areas like loan processing and claims handling. With Robotic Process Automation, approval times are shorter. Clients enjoy a more satisfying interaction with their financial service providers. This, in turn, can lead to increased loyalty and a stronger reputation in a highly competitive market.

- Scale operations. RPA tools can scale rapidly to handle increased workloads. Thus, banks can support business growth more easily.

- Gain a competitive edge. Banks implementing RPA gain advantages over rivals still relying on legacy manual processes.

Want a web app that does more?

Let's build a solution that's smart, sleek, and powerful.

Alina

Client Manager

Advantages of Robotic Process Automation in the Financial Industry

Automation software offers many benefits for financial companies. This section will discuss the main advantages of using RPA in the financial industry. Here's why embracing it is a smart move.

Faster processing

RPA automates repetitive tasks instantly. This allows for much faster processing times. Loans, claims, and other transactions can be handled rapidly with Robotic Process Automation. This improves customer satisfaction through quick turnarounds.

Enhanced compliance

The financial sector is heavily regulated. So, keeping up with compliance can be a headache. RPA software excels in rule-based environments. It ensures strict adherence to rules and regulations when handling data. This reduces compliance risks and penalties.

Increased productivity

Staff waste less time on repetitive manual work. They focus more on high-value tasks like customer service and strategy. This boosts productivity. RPA enables fewer employees to do more.

Improved data quality

Finance mistakes aren't just inconvenient. They can be costly. Humans make errors, but the software doesn't. It follows strict rules without ever getting tired or distracted. Better data enables better analysis and decisions.

Lower operational costs

In finance, where every penny counts, RPA solutions help keep costs down. It takes over repetitive manual tasks. Thus, you can redirect your staff to focus on more complex, value-added activities. By automating routine tasks, robotic process automation for financial services reduces the need for additional staff hours. Less time spent on repetitive work equals more savings. This optimization of the workforce also enhances employee satisfaction.

Rapid scaling

Financial firms face fluctuating demands. Bot technology gives the flexibility to scale operations up or down without the lag of hiring or training new staff. Robots can be deployed quickly, providing a nimble response to changing market conditions.

Seamless integration

Automation software seamlessly integrates legacy systems. It acts as a conduit between platforms, allowing smooth data flows. This creates an integrated IT infrastructure across banking systems. RPA can also integrate processes across departments.

Enhanced analytics

With accurate, high-quality data, RPA enables more advanced analytics. Predictive modeling, customer segmentation, and other analytics are more powerful. RPA allows analysis to efficiently guide business strategy. This drives precision marketing and risk management.

Enhanced customer experience

Fast service and error-free results make customers happy. RPA can handle customer queries, process loans, and manage investments. Happy customers mean loyal customers, and that's great for business.

Round-the-clock workforce

Robots don't sleep. They can work 24/7, keeping systems running smoothly after hours. This constant operation ensures tasks are up-to-date, giving businesses a head start every day.

The Current Status of Robotic Process Automation (RPA) in the Financial Services Industry

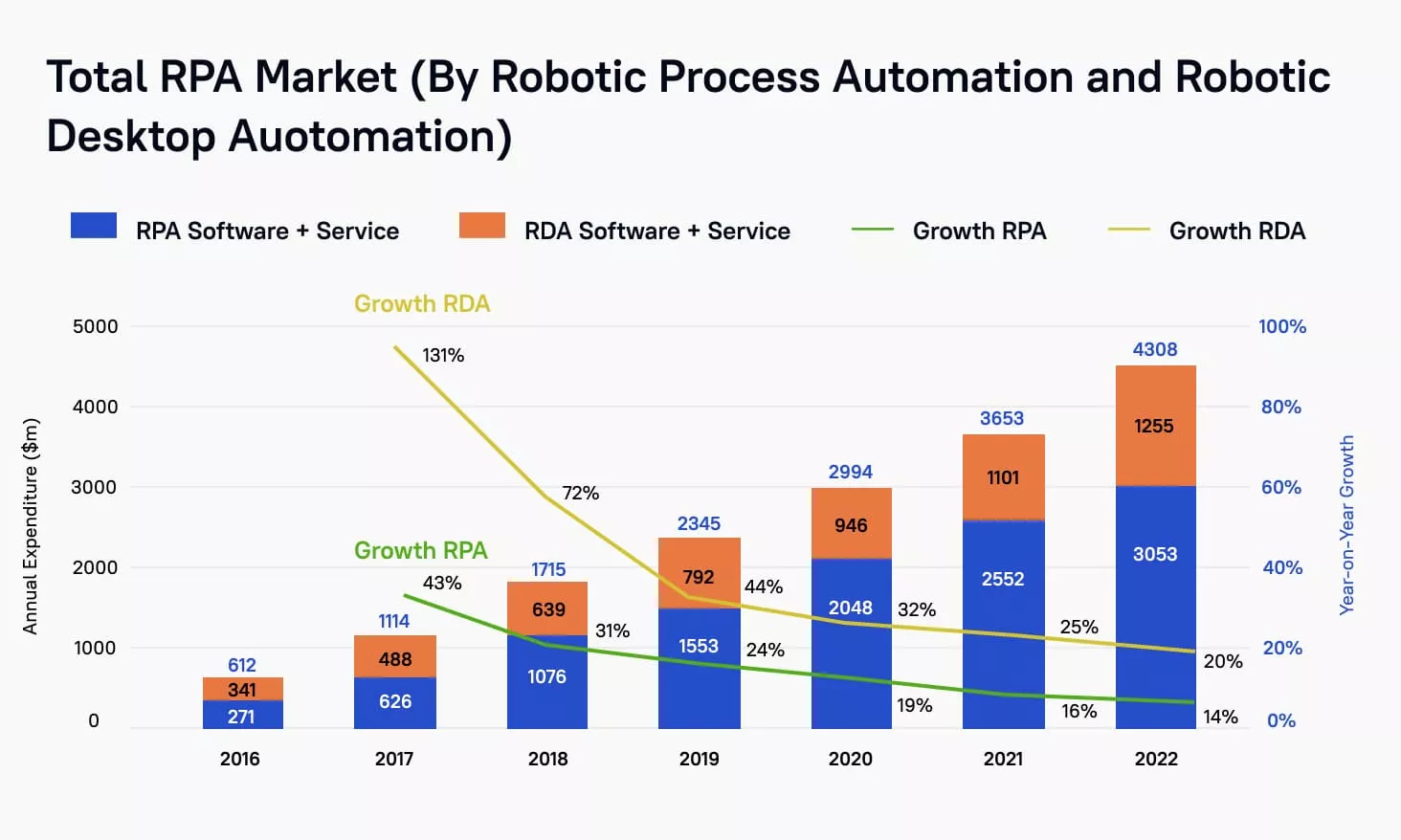

The financial industry is a bustling world where time equals money. Robotic process automation in financial services is not just an emerging trend. It is a powerful force reshaping the sector from the ground up. According to Mordor Intelligence, the RPA market is expected to reach $14.75 billion by 2027, growing at a CAGR of 29.7%.

This surge is driven by the sector's swift adoption of automation software. According to Deloitte, more than 50% of organizations have adopted RPA. This leads to a 30-60% reduction in processing costs. The adoption of Robotic Process Automation in the financial services industry is growing due to

- the increasing need for cost reduction,

- the need for compliance with regulations,

- the growing demand for enhanced operational efficiency.

Top financial institutions are adopting RPA solutions. They are like JPMorgan Chase, Wells Fargo, and Deutsche Bank.

One of the latest trends in the RPA in finance operations is the integration of Robotic Process Automation with cognitive technologies. These are machine learning and natural language processing. This integration enables AI-powered automation. This allows financial institutions to handle complex and unstructured data more effectively.

Another emerging trend is the adoption of cloud-based RPA solutions. They offer scalability, flexibility, and ease of deployment. Thus, organizations can quickly implement and scale automation initiatives.

Available Robotic Process Automation (RPA) Solutions in the Financial Market

RPA offers immense possibilities for automating repetitive tasks and improving efficiency. Robotic process automation tools allow users to create "software robots" or "bots". They can mimic human actions. These can include logging into apps, copying and pasting data, filling out forms, and more.

Implementing RPA in finance operation does not require large upfront investments in technology. Special technical skills are also not necessary. There are a variety of Robotic Process Automation solutions available.

Pre-Made RPA Solutions in the Market

Pre-made solutions may be the best option for companies that want quickly to start with RPA. They allow quick implementation without additional coding. Benefits include:

- lower costs than custom solutions;

- easy savings tracking since each bot automates one process;

- fast rollout.

However, limited functionality may require multiple bots. Additionally, modifications still need developer support.

Free Solutions

Some free solutions provide basic functionality for automating simple tasks. Many free options are the stripped-down versions of paid solutions. They provide a trial experience. Robotic process automation services in finance include:

- UIPath Community Edition. Free RPA tool for automating repetitive processes through desktop apps and web pages. Lacks centralized control but can automate basic tasks.

- Automation Anywhere Bot Store. Library of free ready-made bots for common processes like data entry. Limited in scope.

- Linx. Linx is a no-code robotic process automation platform. It enables rapid development and deployment of automated workflows. Linx provides a visual designer to build bots without coding. It also simplifies connecting to SaaS apps, legacy systems, and various databases.

These solutions provide basic process automation capabilities for small projects. They allow financial firms to test automation software without a large investment. The main benefit is the low barrier to adoption.

Paid Solutions

More powerful paid RPA platforms allow the automation of more complex processes. They also add centralized management and analytics. Leading options include:

- Blue Prism. It is a comprehensive platform for financial services organizations. Blue Prism provides advanced automation capabilities, scalability, and security features. It is used to automate processes. They are customer onboarding, account reconciliation, and compliance reporting.

- UiPath. This is a leading end-to-end robotic automation platform. UiPath offers advanced computer vision technology and AI capabilities on an enterprise-ready platform. It is a leading solution for automating GUI, web, and SAP processes. A free version is available but paid has more security and automation capabilities.

- Kofax. Kofax markets itself as an intelligent automation provider. They claim it goes beyond basic RPA with embedded AI. This enables robots to handle more complex and unstructured data tasks. The company offers an open architecture that integrates with an organization's existing landscape.

- WorkFusion. It is an AI-driven RPA combining rule-based and intelligent automation. It allows automating repetitive tasks and extracting data from unstructured documents. It leverages intelligent automation for complex finance processes.

The main advantage of pre-made solutions is fast deployment, often taking just weeks. They also need less technical expertise to implement. Limitations include less flexibility to handle unique processes and third-party vendors managing updates.

Custom RPA Solutions

Financial institutions can work with specialized consultants and developers to build custom solutions. The ones tailored to their specific needs. This approach is preferable for large firms. Though more expensive upfront, custom RPA can optimize intricate workflows. It integrates systems in a unified automation framework. Benefits include:

- Seamless integration with existing platforms and data sources. Automation tools communicate fluidly with current platforms, databases, and applications. This seamless integration avoids the need for extensive system overhauls or data migrations. The latter can be both risky and costly.

- Flexibility to automate niche procedures. Every financial institution has unique processes that set it apart from competitors. Custom RPA solutions can be programmed to handle these specialized tasks.

- Enhanced scalability. Since these solutions are built with the specific institution in mind, scaling up doesn't just mean adding more bots. It involves deepening the integration and extending the automation to additional processes. All of these are without a drop in performance.

- Higher accuracy. Bots can be trained using company-specific data and use cases. This results in higher accuracy, fewer errors, and less manual intervention.

- Better security. Organizations have direct control over data and systems bots access, reducing security risks. IP and sensitive information stays in-house.

- Full ownership. No reliance on vendor roadmaps. Companies own and control all RPA assets, code, and algorithms.

RPA in Finance Operations Use Cases

This section will explore key RPA use cases in finance.

RPA in Accounts Receivables

One of the major RPA use cases in finance is accounts receivable. This function directly impacts the cash flow and financial health of an organization. Automation software can reduce the time spent on manual entry and follow-ups. It's done by automating tasks like invoice processing, payment reconciliation, and credit management. Bot technology ensures accuracy in data entry. It can even predict payment delays by analyzing payment history. Thus it helps to maintain a healthy cash flow.

RPA in Accounts Payable

The accounts payable (AP) process can be labor-intensive. It involves invoice receipt, validation, approval, and payment. Robotic Process Automation addresses these challenges by automating the end-to-end process of AP. Bots can extract invoice data, match it with purchase orders, route invoices for approval, and execute payments. They do all these things without human intervention.

RPA in Investment Management

Investment management is a complex field. It requires precision, real-time data analysis, and compliance with regulations. RPA for financial services shines here. They automate repetitive tasks such as data collection for market analysis, portfolio management, and reporting. Investment firms can handle large transaction volumes. Bots can integrate across core systems to gather client data and ensure adherence to regulations.

Additionally, bot technology can monitor regulatory compliance. It keeps track of changing regulations and adjusts processes accordingly. This mitigates the risk of non-compliance.

RPA in Trade Processing

Another use is robotic process automation in trade finance. Executing stock trades involves exchanging order information between various parties and ensuring trade details match on both sides. Bots can compare trade capture reports. They can also highlight any mismatches and resolve exceptions through automated workflows. This results in faster, more accurate trade confirmations and settlements.

RPA in Account Opening and Onboarding

Account opening and customer onboarding is another promising RPA application. Bots can extract and validate customer data from documents. They can input information into systems and complete identity verification steps per KYC/AML regulations. Standardizing this process with automation delivers efficiency gains. It also delivers a better applicant experience.

RPA in Loan Processing

Software robots can gather financial information and documents from applicants. They also calculate income and debt ratios, pull credit reports, and determine if lending criteria are met. They only escalate more complex cases to human underwriters. This allows banks to handle higher loan volumes without staffing up.

RPA in Account Reconciliation

Reconciling accounts is a monotonous financial task. Bots can automate it seamlessly. Automation software can:

- compare transactions across systems;

- match invoices to payments;

- identify discrepancies in ledgers;

- resolve routine issues to ensure book balance.

This saves accountants and controllers time spent on repetitive reconciliation work.

RPA in Anti-Money Laundering Monitoring

Banks are using Robotic Process Automation to optimize anti-money laundering transaction monitoring. Bots can quickly analyze customer activity across accounts to detect suspicious patterns indicative of money laundering, terrorist financing, or other financial crimes. RPA allows more transactions to be screened with greater accuracy. As a result, institutions can better comply with AML regulations.

Benefits and Challenges

We already analyzed the benefits of robotic process automation possibilities for the financial services industry above. Benefits like improved accuracy and faster processing are clear. However, RPA also faces challenges like

- high upfront costs;

- integrating with legacy systems;

- changing processes post-implementation;

- managing bots like employees;

- and potential workforce reductions.

The robotic process automation possibilities for the financial services industry are immense. Yet, companies need to evaluate the benefits and challenges before implementation.

FAQ about RPA in Finance

Still, have questions about RPA in financial services? This FAQ section is for you. The quick answers below will bring you up to speed on the ins and outs of Robotic Process Automation in financial services.

What are some common use cases for RPA in Finance?

Some common use cases for RPA in finance include automating reporting, reconciliations, transaction processing, data entry, and regulatory compliance tasks. RPA is commonly used in accounts payable, accounts receivable, and investment management. It is also popular for general ledger, auditing, financial planning and analysis, and tax processes.

What types of tasks can be automated using RPA in Finance?

RPA can automate repetitive, rules-based tasks in finance, including:

- Data entry and data transfer between systems

- Populating reports/templates

- Reconciling accounts

- Processing invoices and payments

- Matching orders to invoices and shipments

- Journal entry creation

- Following up on unpaid invoices

- Applying payments received to customer accounts

- Gathering data for audits and compliance reporting

What software tools are commonly used for RPA in Finance?

Some popular automation software platforms used in finance include:

- UiPath

- Automation Anywhere

- Blue Prism

- WorkFusion

- Kryon Systems

- EdgeVerve Systems

- PegaSystems

- Redwood Software

- Kofax

These tools allow non-technical users to configure software robots through easy-to-use graphical interfaces and workflows. The robots can integrate with existing IT systems to automate repetitive tasks faster and more accurately than humans.

The Final Word

As finance continues to adopt new technologies, robotic process automation in the finance function of the future promises to enhance efficiency and productivity. Partnering with experienced developers like Stfalcon will allow you to harness the benefits of automation. Stfalcon shines as an expert in making financial software run smoothly with automation, backed by a rich history of successful projects and plenty of experience.

Working together, we can bring several benefits to you. Our team consists of skilled experts with years of experience in the industry. We have successfully delivered over 324 projects and have received top ratings for our services. Stfalcon is known for its customer-oriented approach and commitment to meeting business needs.

Contact Stfalcon for professional RPA solutions tailored to your enterprise. Let's advance together.