Even the best systems fail when operations run on adrenaline. In logistics, operations always run on adrenaline — the software has to keep up or get out of the way. As a team building logistics software since 2009 for companies like Nova Post and Ecolines, we at Stfalcon have seen this up close.

This article explains why building logistics software often goes wrong, why technical talent alone isn't enough, and what signals actually matter when evaluating a development partner.

3 failure patterns in how logistics software gets built (and why outsourcing blows up each one)

From our experience, we see three common reasons why logistics software development goes south.

Pattern #1: Software that can't handle exceptions

When a winter storm disrupted Southwest Airlines’ schedules in December 2022, their legacy crew scheduling system couldn't reassign pilots and flight attendants to available planes. Crew members called a hotline and waited on hold for hours, some overnight. Two-thirds of its flights were canceled, leaving two million passengers stranded. The Department of Transportation imposed a $140 million penalty.

Southwest built this system internally, and got it wrong.

The pattern they hit is everywhere in logistics: development teams build and test for the “happy path” with normal operating conditions (scheduled crews, predictable weather windows, resources available as planned). Real logistics operations are nothing but. A refused delivery, a carrier no-show, an appointment window moved up by four hours are 30–40% of daily operations, and not edge cases.

Seasoned ops teams know to design for failures first, because failures will happen, and when they do, the software either handles them or becomes the bottleneck. When you outsource to a team that doesn't live in logistics, you get happy-path thinking by default because they don't know which exceptions to design for.

Pattern #2: Developers lacking domain knowledge

A captain loading containers noticed his ship was riding deeper and tilting more than expected, so he called the planners. The developer investigated and found the software was sending gross weights into a system expecting net weights — a 3,000 kg per-container error. What he thought of as “boring logistics software at the time, where the worst that could happen was losing a container for a day or so” turned out to be a rude awakening.

The developer didn't know what he didn't know, and that's another pattern we observe.

Logistics software touches the physical world in ways most developers never see. Terminology matters (gross vs. net weight, tare vs. payload, cube vs. density), but so do operational realities: which weight limits trigger DOT inspections, how load distribution affects vehicle stability, when a seemingly minor delay cascades into missed appointment windows across three states.

If you outsource to teams without domain expertise, you're betting they'll ask the right questions during discovery. Most don’t.

Pattern #3: Transformation projects that ignore operational reality

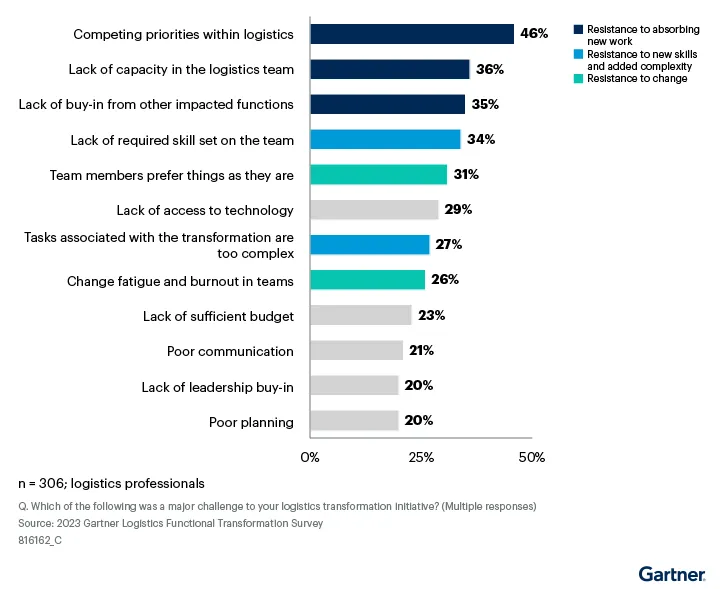

In 2024, Gartner found that 76% of logistics transformation projects to meet performance metrics. The reason isn’t technology – and not even budget. We’re to blame competing priorities (46%), lack of team capacity (36%), and resistance from other departments (35%).

Vendors build ambitious transformation roadmaps for their clients and don’t account for the fact that the operations team:

- is running at 110% capacity

- can't spare people for training/testing

- will resist anything that adds complexity to their already-chaotic day

Software vendors pitch what should work: sophisticated new systems, “streamlined workflows,” powerful integrations. What they don't see, for example, is that a dispatch manager handles 200+ shipments a day and can't stop to learn new software.

The Beaver Street Fisheries (US manufacturer and distributor of frozen seafood) case is textbook here. They hired consultants to customize Blue Yonder WMS. Consultants “promised much, but failed to deliver.” Months of billing, no useful results. The vendors knew the software, but didn't know the client's operational reality.

These three patterns we see? They all stem from the same root cause: treating logistics software like any other development project.

Need software that can handle your operational reality?

We build custom logistics tech for modern supply chains.

Alina

Client Manager

Why technical talent isn’t enough for building logistics software

You've probably heard some version of this (and probably too many times):

“We'll streamline your operations with smart automation!”

Outsiders think logistics is complex because of “bad” software that needs modernizing. Six months later, they discover the complexity is in the domain itself.

You can't code around the fact that 30–40% of logistics operations are edge cases. You can't build transformation roadmaps when the ops team is already at 110% capacity. You can’t assume data will arrive consistently formatted and complete, when logistics runs on mismatched BOL formats, API timeouts during peak periods, and weather delays that cascade across states.

Domain expertise is what separates reliable software from the one that gets ignored in favor of Excel and phone calls.

How to evaluate your logistics software development partner

So how do you tell if a development partner actually has logistics expertise, besides posh claims on their website? Here's what to look for.

True logistics expertise shows in 4 ways

Before you hop on a first call, take note of the following points.

| ✔ They describe your workflow back accurately | ✔ They ask “what breaks?” before “what features?” |

| ✔ They speak logistics naturally | ✔ They add buffer time for data problems |

- They can describe your operation back to you. Not just parrot what you said, but show they understand the constraints. For example, when you describe dispatch, they should spot issues you didn't mention: "So when a driver's HOS limit hits mid-route, how do you handle the relay?"

- They want to know what breaks before building anything new. "What happens when a carrier no-shows?", not "Which dashboard features do you want?"

- They speak logistics fluently. They don't need you to define terms, and they don't use the wrong words for things.

- Their timeline includes buffer time for integration problems and data issues: Carrier API failures, mismatched EDI formats, data cleanup.

How we run logistics projects at Stfalcon: 3 core principles

After 16+ years building logistics and custom transportation software, we learned that engagement structure matters as much as technical skills. Here are three core principles we always stick to, shown via our clients’ stories.

Discovery: Mapping operational reality

A discovery phase in logistics projects is where we get to know the client's ops team. Sometimes it's a Product Owner who covers all operational contexts, sometimes it's a cross-functional team (logistics manager, operations, finance, technical lead). Either way, we talk to people who know what is and isn’t working in daily operations.

We analyze 8 operational areas that determine how the software will behave under real conditions:

- Order lifecycle (from request to closing)

- Dispatch logic (manual, semi-automatic, or fully automated)

- Route planning and optimization

- Fleet and driver management

- Exception handling (delays, cancellations, changes, incidents)

- Status updates and communication flows

- Billing and settlements

- Integrations with external systems (ERP, TMS, telematics, GPS trackers, fuel systems, time tracking)

The Discovery output includes process maps for key scenarios, user journeys for each role, integration diagrams showing data flows between systems, and a preliminary estimate with phased timelines. This package becomes the blueprint that prevents scope creep and missed requirements later.

| Example of Stfalcon's discovery phase for logistics projects | ||

|---|---|---|

ANALYZE 8 AREAS

| PRODUCE 4 DELIVERABLES

| RESULT Blueprint that prevents scope creep and missed requirements |

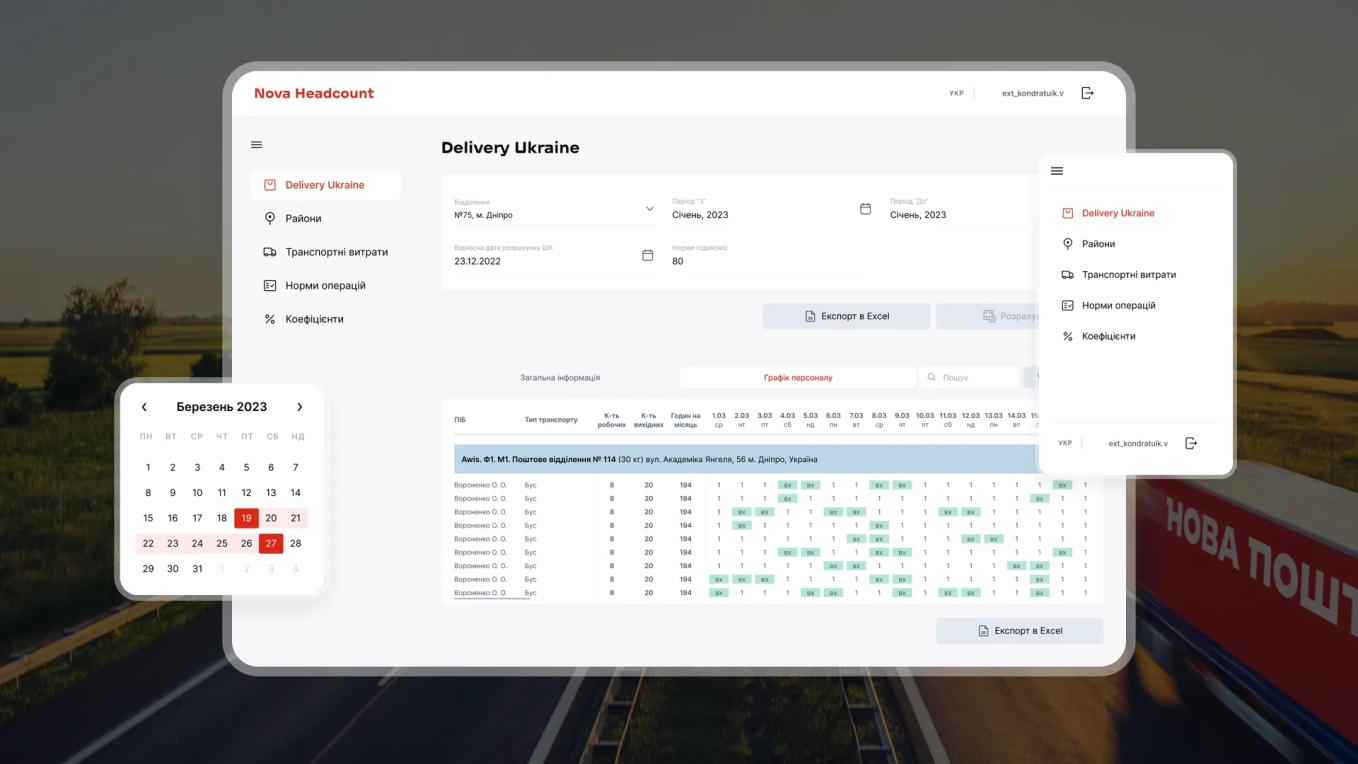

Case in point: Nova Post, Ukraine’s biggest delivery service

Nova Post managers scheduled shifts across 13,000 offices with Excel. Office staffing needs varied by location, season, local events, and parcel volume. Using spreadsheets to deal with this variability became…complicated: managers spent hours daily on manual planning.

In discovery, we mapped operational constraints:

- How do staffing needs change when parcel volume spikes?

- What happens when unexpected delivery surges hit smaller offices?

- Which manual workarounds does Excel force on managers?

The resulting system (Nova Headcount) automates 99% of manual scheduling work and processes nationwide staffing data 4x faster than the previous manual process.

Governance: Operational KPIs, not development velocity

We tie KPIs to operational challenges. Most clients come to us to optimize costs, so economic indicators usually take priority. But we recommend balancing them across four categories.

| KPI framework for logistics software projects | |

|---|---|

OPERATIONAL EFFICIENCY

| ECONOMIC INDICATORS

|

SERVICE QUALITY

| TECHNICAL PERFORMANCE

|

Operational efficiency

- On-time delivery rate: percentage of deliveries made on time

- Average delivery time: mean time from pickup to delivery

- Route efficiency: ratio of planned vs. actual route

- Utilization rate: fleet or driver utilization percentage

Economic indicators

- Cost per delivery: total delivery cost divided by number of deliveries

- Fuel or mileage efficiency: fuel consumption or mileage per order

- Revenue per vehicle/driver: revenue generated per unit of transport or driver

Service quality

- Failed delivery rate: percentage of deliveries that fail on first attempt

- Customer satisfaction (CSAT/NPS)

- Average response time (to order or incident)

Technical system performance

- System uptime: system availability percentage

- Time to assign an order: duration from order creation to driver assignment

- Error or incident rate: number of technical failures

When a project starts, it's enough to choose 3–4 KPIs that align with your biggest operational pain point. For most logistics projects, we recommend starting with on-time delivery rate, cost per delivery, utilization rate, and failed delivery rate. As the system matures, add additional metrics from other categories.

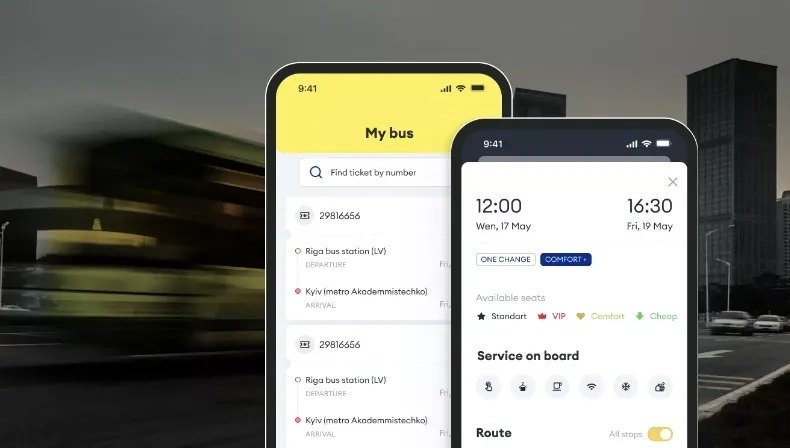

Case in point: Ecolines mobile app

Ecolines, an international bus carrier operating routes across Europe, had a mobile app that worked, technically. Users could browse schedules, check departure times, and see routes. But they weren't buying tickets. Negative App Store reviews pointed at confusing booking flow and unclear pricing.

Given this context, we tracked conversion rate: the percentage of users who went from browsing routes to completed purchase. Every design decision got validated against one question:

Does this reduce friction between browsing and booking?

The rebuilt app doubled ticket bookings, while we “succeeded in our main task — to make passenger booking as simple as possible,” said Tomass, Ecolines’s Head of E-commerce.

Implementation: Phased rollout during non-peak periods

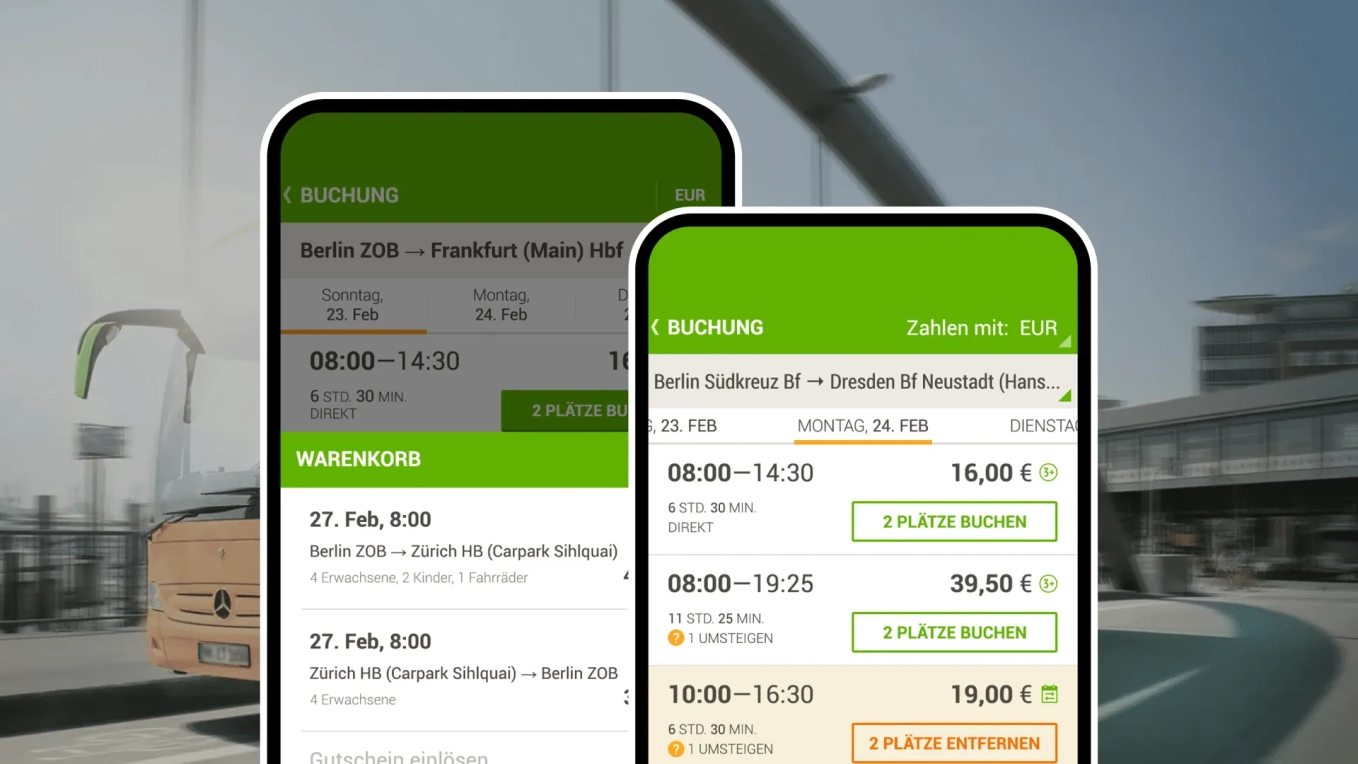

We launch in phases: core functionality first, complex integrations later. For the Berlin bus booking platform, that meant launching booking and reservations first, then adding partner integrations. For mission-critical systems, we run parallel operations before full cutover. Like with Nova Post's new scheduling system.

Our development team ran it alongside their existing Excel process for several weeks. Managers could compare outputs and catch edge cases. Post-launch monitoring focused on real operational stress: holiday volume spikes, last-minute office closures, or sudden staffing shortages.

3 logistics-focused software development outsourcing companies worth considering

Now, if you’re considering partnering with a tech vendor, you’ll find many vendors claiming they understand logistics. What about the proof?

Below are three logistics-focused software development companies (us included) with verified case studies.

Stfalcon

- Clutch rating: 4.9/5 (56 reviews)

- Offices: Ukraine, Estonia

- Projects range: $10K–$200K+

- Specialization: Supply chain, fleet management, and order and delivery systems. ISO 9001:2015 certified for quality management.

Domain proof:

- Nova Post shift scheduling system automates 99% of manual work, processes data 4x faster.

- Ecolines mobile app overhaul doubled ticket bookings.

- Berlin bus startup captured 40%+ market share with their booking platform.

- A Gemini-powered AI agent reduced customs document processing time by 67%.

Work with a team that gets your industry

Book a free 30-minute consultation to discuss your logistics project.

Alina

Client Manager

Cleveroad

- Clutch rating: 4.9/5 (77 reviews)

- Offices: Norway, USA, Ukraine

- Projects range: $10K–$250K+

- Specialization: Transportation management systems, fleet management, warehouse operations, last-mile delivery. ISO 9001:2015 certified for quality management and ISO/IEC 27001:2013 certified for information security.

Domain proof:

- Built TMS for US logistics company (warehousing + long-distance freight) with automated route planning that reduced idle time 27–36%.

- Integrated with existing WMS and CRM.

- MoveUp platform serves passengers with medical/accessibility needs with real-time tracking and AI route selection.

Limeup

- Clutch rating: 5.0 (11 reviews)

- Offices: UK, Germany, Poland

- Projects range: $30K+

- Specialization: Warehouse management, freight platforms, international supply chain systems.

Domain proof:

- WareSync WMS achieved 99.95% uptime under load, processed 1M+ stock updates in the first 3 months, 2x faster vendor onboarding.

- Logifleet freight platform handles 500K+ weekly geolocation events, 40% faster response times.

- Built web + mobile apps with live tracking and in-app communication.

Bottom line

For logistics leaders evaluating development partners, the question isn't “Can they deliver on time?” It's specifics, like “Do they understand why a driver's hours-of-service status might matter more than an optimized route?”

At Stfalcon, we've spent 16+ years building logistics software that keeps up when ops are running on adrenaline. If we sound like a fitting partner, let's talk about your project.

Read the full case study

Read the full case study

Read the full case study

Read the full case study

Read the full case study

Read the full case study