Traditional business plans can be time-consuming and cumbersome. They often include lengthy market analyses and complicated financial projections. The Lean Canvas offers a better option: a simple one-page business plan template. It is designed for startups to test their ideas and make changes quickly.

The Lean Canvas simplifies planning by focusing on nine essential building blocks. By completing these blocks, entrepreneurs clearly understand their target market, unique selling proposition, and the key challenges they must address. This iterative approach facilitates rapid experimentation, encourages early customer feedback, and promotes continuous improvement. As a result, startups can quickly adapt to changing market conditions and achieve product-market fit.

Stfalcon's specialists consistently use the Lean Canvas model during the software product discovery services for our projects. Over the years, we have gathered insights into how to gain a deep understanding of the market, our client's business, and the target audience. Now, we are going to walk you through this process.

Lean Canvas Model Explained: What Is Lean Canvas?

Ash Maurya developed this model as an alternative to the Business Model Canvas. It helps startups focus on customer problems and find solutions. This model guides them in delivering these solutions to their customer segments with a unique value proposition.

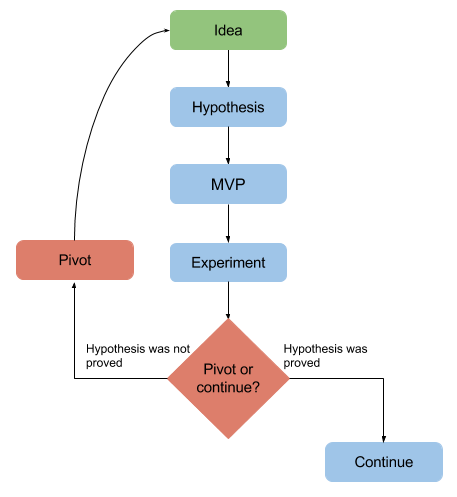

The lean concept of startup development is based on three principles:

- Instead of taking months to plan and analyze the market for the perfect business plan, startup founders should focus on creating a hypothesis. Based on that hypothesis, they can use a Business Model Canvas or Lean Model Canvas template to fill in their ideas. These models show how the startup is going to create value.

- Customer development requires startupers to leave the building and talk to potential customers to identify their needs and get feedback on the hypothesis implemented in the MVP. Based on the feedback, MVP is improved, and a new cycle begins, or a decision to pivot startup is made.

- Following agile development — it is assumed that after each iteration, teams get a finished product that is tested according to the customer development approach and improved.

Every ean canvas business model is functioning according to this scheme:

This model offers a simpler option than extended business plans. It is designed for startups in the early stages of their business. Please note that it should not be confused with the Business Model Canvas, so to avoid that, let's discuss their differences.

Your Lean Canvas is just the beginning

Let’s turn it into a product that customers actually love — fast, flexible, and ready to scale.

Alina

Client Manager

Business Model Canvas Explained: What Is BMC and How It Differs from Lean Canvas?

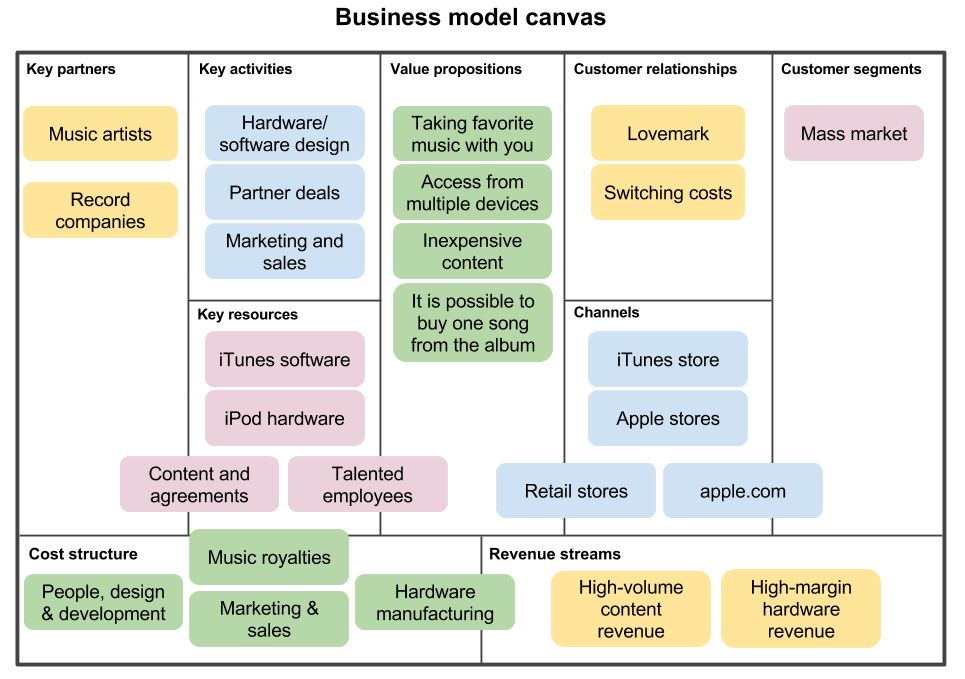

It’s a canvas Alex Osterwalder describes in his book “Business Model Generation: A Handbook For Visionaries, Game Changers, And Challengers.” It consists of nine blocks:

- Customer segments are groups of clients included in your startup business model.

- Value propositions are advantages a startup offers its users. For example, for Instacart, that is the ability to get necessary products without spending time on shopping.

- Distribution channels are the channels you use to sell your product. For apps, these would be the Apple Store or Google Play.

- Customer relations are established and maintained by all members of the team communicating with customers.

- Revenue streams are your sources of income. It could be one-time purchases or subscriptions.

- Key resources the startup relies on: material, intellectual, financial and human.

- Key activities performed by the startup.

- Key partners that help your startup function: provide resources, consultations or assist in other ways.

- Cost structure refers to expenses associated with the model. They depend on key activities, resources, and partners.

Here’s an example of lean business model canvas by Alex Osterwalder for iPod/iTunes:

The business model canvas highlights several value propositions. These include a low cost for each track, the option to buy just one song from an album, and the convenience of taking music with you wherever you go. The services were made for a broad audience, so they earned money by selling a large amount of content to users and from the high profits of iPod players.

Use this business model canvas for Google Draw to create canvas for your startup ideas quickly.

Why is the Lean Canvas Essential for Startups?

Ash Maurya suggests using the lean startup canvas he introduced in his book “Running Lean” instead of the business model canvas. He understood lean methodology by Eric Ries and client development by Steve Blank. He aimed to focus only on the elements that pose the most risk in his lean canvas model example. Here they are:

- Problem. Startups fail because they aren’t solving user problems. Read our article to learn more about startups solving user problems.

- Solution. In Ash’s model, it is placed in a small box since it should be simple, just as its implementation called minimum viable product.

- Key metrics. To prevent your startup from drowning in piles of data and vanity metrics, you need to clearly specify indicators used to measure its effectiveness.

- Unfair advantage. If your startup is unique, it might not have many competitors at first. However, you need to think about the future because copycats can appear quickly, just like what happened with Uber. That’s why you must find an advantage that will set your startup apart from the competitors.

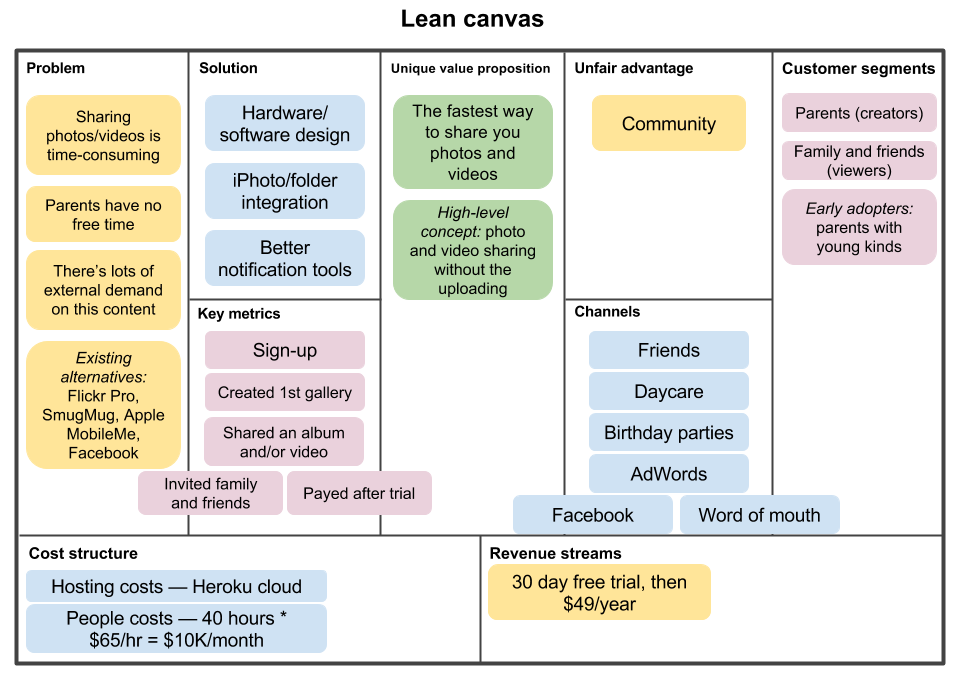

Here’s a lean canvas example for a photosharing desktop app CloudFlare Ash Maurya provides in his book:

The service addresses the problem of spending too much time downloading and uploading photos. The unique value proposition is the quick automated sharing of pictures and videos. The service was subscription-based with a free trial. Key metrics included:

- registration

- first gallery creation

- sharing gallery with friends

- inviting family and friends

- subscription purchase.

Use this lean canvas template for Google Draw to quickly create canvas for your startup ideas.

Lean Canvas does a better job at capturing answers to the questions essential for any startup:

- What user problem does the startup solve?

- What solution is the startup offering?

- What about its uniqueness? What advantage will allow the startup to leave its competitors behind?

- Who is the startup's target audience?

- How are you going to measure startup effectiveness?

- Which channels will be used for promotion?

- What expenses will startup operation require?

- How will the startup earn money?

While planning lean startup development you can also use impact mapping and other mind mapping tools.

Lean Canvas Examples from Billion-Dollar Startups

It’s hard to know the exact Lean Canvas companies used when they started. However, we can examine their journeys to see how this framework might have helped them.

Airbnb

Airbnb initially focused on addressing the issues of expensive and impersonal travel. Its unique value proposition of connecting travelers with local experiences likely played a crucial role in its success.

- Problem: Finding affordable and unique places to stay can be challenging for travelers. This is especially true for those who want experiences beyond regular hotels.

- Solution: A platform that connects travelers with hosts renting homes, apartments, or unique spaces.

- Value Proposition: Affordable and authentic travel experiences, unique accommodations, and community access.

- Customer Segments: Travelers looking for budget-friendly options, unique experiences, and a local atmosphere; homeowners with spare rooms or distinctive properties.

Uber

Uber's Lean Canvas likely addressed the issue of unreliable transportation. It emphasized the value of providing a convenient and affordable solution. Uber focused on urban commuters and busy professionals to better meet their needs. This allowed Uber to customize its services for this specific market.

- Problem: Transportation options in cities are often unreliable and inconsistent. Many people find it hard to access affordable and convenient rides.

- Solution: A smartphone app connecting riders with nearby drivers of private vehicles for hire.

- Value Proposition: Affordable, convenient transportation at the tap of a button, including fare estimates and driver tracking.

- Customer Segments: Urban commuters, professionals, and students seeking alternatives to taxis or public transport.

Slack

Slack's Lean Canvas likely emphasized the problem of inefficient communication and showcased the value of a centralized and integrated platform. By concentrating on customer segments such as businesses and teams within organizations, they could tailor their services to meet specific needs and workflows.

- Problem: Poor communication among team members reduces productivity and creates information silos.

- Solution: A cloud-based platform for messaging and collaboration that integrates various communication tools and features for teams.

- Value Proposition: Effective communication, enhanced productivity, better information sharing, and a central hub for team collaboration.

- Customer Segments: Companies of all sizes, teams within organizations, and individuals looking for a more effective way to communicate and collaborate.

Benefits of Lean Canvas: Why Startups Use the Template

Using the Lean Canvas template offers many benefits for startups. It is a helpful tool for entrepreneurs who want to develop and improve their business ideas quickly. Here are the key benefits:

- Simplicity and Clarity. The Lean Model Canvas gives a clear, one-page overview of complex business ideas. This makes it easy to understand and share. By keeping it simple, entrepreneurs can focus on the important parts without getting lost in extra details.

- Speed. The Lean Canvas is much quicker to create and iterate than traditional business plans. Startups can draft their initial version in a matter of hours, enabling faster decision-making and testing of ideas.

- Flexibility. As you gather feedback and learn more about your customers, you can easily update the canvas to include new insights and change your strategy as needed.

- Customer Centricity. The Lean Canvas emphasizes understanding customer problems and tailoring solutions to their specific needs. This customer-centric approach increases the likelihood of developing a product or service that resonates with the market.

- Risk Management. The Lean Canvas helps you find potential problems and test your ideas early. It reduces risks and increases your chances of success. It also streamlines the planning process, allowing startups to launch and iterate more quickly.

- Improved Communication. The visual format of the Lean Canvas facilitates easy communication and collaboration among team members, investors, and other stakeholders. Everyone can quickly grasp the core business idea and its key elements.

- Enhanced Decision Making. The Lean Product Canvas provides a framework for making informed decisions about product development, marketing, and other key aspects of the business. By looking at the information on the canvas, you can find possible challenges and opportunities. This helps you make decisions based on data.

How to Create a Lean Canvas: Step-by-Step Guide

Creating a Lean Canvas for a business involves breaking down your idea into its core components. By its very nature, a Lean Canvas is designed to fit on a single page and, after the initial research, is supposed to be completed in one sitting. The most common mistake you can make is to add too little or too much information. If you lack important data, returning to the initial research is the best step. If you have a lot of essential data that doesn't fit well into a Lean Canvas, it's better to break it into several documents. For example, you can create several Lean Canvases focused on different customer categories.

Though Lean Canvas is designed to be as flexible as possible, we suggest you follow the steps in a specific order. The Lean Canvas blocks are designed to follow each other logically.

- Step 1: Define the Problem

Before filling in this block, you must conduct thorough market research to identify customer pain points and unmet needs. Then, you need to define a specific problem (or problems) your product addresses.

- Step 2: Identify Customer Segments

Define your ideal customer: who are you trying to solve this problem for? Be as specific as possible, including age, demographics, location, interests, behaviors, needs, etc. Consider creating customer personas to better understand your target audience.

- Step 3: Develop the Solution

Brainstorm and evaluate potential solutions to the problem you’ve established. This will help you determine your unique value proposition.

- Step 4: Define Revenue Streams

Identify how you will generate revenue. Explore different pricing models (e.g., subscription, one-time purchase). Be realistic and consider the pricing model that best suits your business.

- Step 5: Define Unique Value Proposition

Clearly articulate your unique value. What makes your solution stand out from the competition? What are the key differentiators? Here, you need to focus on the customer's benefits, not just the features.

- Step 6: Determine Channels

Decide how you will reach your target customers. Consider online channels (social media, search engine marketing, email marketing), offline channels (partnerships, events), or a combination of both.

- Step 7: Define Key Metrics

Define the key metrics that will measure your success. What data will you track to determine if your business is on the right track? This may be customer acquisition cost, customer lifetime value, churn rate, website traffic, or conversion rates—whatever is relevant to your business.

- Step 8: Analyze Cost Structure

Identify and estimate all relevant costs associated with your business. Include fixed costs (rent, salaries, software) and variable costs (materials, production, marketing).

- Step 9: Identify Unfair Advantages

Determine factors that give your business a competitive edge. These could include intellectual property, a strong team, unique technology, a strong brand, and a loyal customer base—anything your competitors can't quickly copy.

Remember that at the early stage, your Lean Canvas mainly consists of assumptions. You still have a lot of work ahead of you. First, test your assumptions. Next, gather feedback from customers. Finally, adjust your strategy based on what you learn from these steps.

Stfalcon’s Experience

While working on our projects with clients, we have continually appreciated using Lean Canvas as a gatekeeping tool to capture key information during the discovery phase. This helps us design more relevant and tailor-made solutions by giving an insight into each client's challenges and opportunities.

IMBI

Imbi is a revolutionary social app that helps users socialize, find new communication partners, and meet instantly. For this project, we completed the Lean Canvas during the discovery phase services to gain a deeper understanding of the product. We paid special attention to studying our competitors, as there are many dating apps available on the market.

We identified our application's strengths and developed strategies for monetizing the product. We created two proto-personas, each with its own scenario: the user who creates the meeting and the user who responds to the meeting.

As a result, we moved away from dating app ideas and created a space for communication and the exchange of emotions. Users can plan meetings quickly, easily, and affordably at their chosen location.

Smilefood

Our client came to us with a request to redesign their food delivery app, which was performing ineffectively and failing at every upgrade. As we had to deal with an already existing business, we used the Business Model Canvas approach during the discovery phase. It allowed us to understand the business and its problems deeply.

We researched our competitors, talked to app users, and mapped out customer journeys. We found an interesting insight: placing a follow-up order in the first 20 minutes is very useful.

Conclusion: Why Lean Canvas Still Works

The Lean Canvas is an effective framework that helps startups navigate the complexities of entrepreneurship. By concentrating on essential elements such as customer problems, value propositions, and revenue streams, entrepreneurs can quickly validate their ideas, identify potential challenges, and make informed decisions. This approach helps startups to be flexible and quick. It allows them to change direction easily and respond well to shifts in the market. Stfalcon's expert has already assisted many businesses in visualizing their ideas and turning them into strategies.

Have a startup idea? Contact Stfalcon and we will help it succeed!

FAQ

What are the disadvantages of a Lean Canvas?

While the Lean Canvas provides valuable benefits for startups, it also has some limitations. It may oversimplify complex business models and may not offer the depth needed for thorough analysis in specific areas. The way people view the process can influence the results. Focusing on quick validation might distract from long-term planning. Additionally, it may not be suitable for all businesses, particularly those with complex operations or those operating in highly regulated industries.

Should I choose Lean Canvas or Business Model Canvas?

The choice between Lean Canvas and Business Model Canvas depends on your specific needs and the stage of your project. Lean Canvas is best for early-stage startups, validating initial ideas and rapid experimentation. The Business Model Canvas is a good option for more established businesses. It helps with strategic planning and provides a clear understanding of the overall business model.

Is Lean Canvas Agile?

The Lean Canvas is not a complete agile method like Scrum or Kanban but includes many key agile ideas. These ideas are flexibility, iteration, and a focus on the customer. The Lean Canvas promotes ongoing improvement and change based on feedback and new insights. It focuses on the customer and allows teams to customize the process to fit their specific needs and priorities.

Don't miss this opportunity to fast-track your path to lean startup development success. Download Stfalcon's whitepaper "7 Recipes on How to Get a Startup Idea" today. Embark on your journey to efficiently plan and execute your startup idea. Your blueprint for lean and agile success begins here.

Read the full case study

Read the full case study

Read the full case study

Read the full case study